Published By The USA Today

DETROIT -- In downtrodden Michigan, the hot topics for conversation in the past six months have been such depressing subjects as bailouts and bankruptcy, layoffs and plant closings, even the disappointing Stanley Cup playoff loss by the NHL's Detroit Red Wings.

So it's been a relief lately to have something else for people to buzz about: celebrity sightings.

We're not talking the D-list: Stars have included George Clooney, Drew Barrymore, Al Pacino, Clint Eastwood, Edward Norton and Hillary Swank.

The gypsy-like movie industry, which roams from place to place to find the best locations -- and best deals -- has taken a liking to Michigan in the past two years. That's thanks in part to generous tax incentives that give the entertainment industry a refundable business tax credit of up to 42% for production costs spent in the state.

Some lawmakers argue that the tax credit is too generous for a state with an enormous budget deficit and the nation's highest unemployment rate, topping 15% in June, but there's no arguing the fact that the credit has generated business. In 2007, before Michigan offered the credit, two films were shot there. In 2008, after the credit was enacted, 35 films were, according to the Michigan Film Office. In 2009, there are already 85 movies made or with production applications filed with the state.

In 2007, moviemakers spent $2 million producing in the Great Lakes state. In 2008, that soared to $125 million. This year's spending hasn't been tabulated.

"If you're going to go back and say we can't afford this, I would say you don't understand the true value of the program," says Jim Burnstein, a screenwriter and professor at the University of Michigan who helped the state develop the tax credit. Burnstein says he's worried the tax credit will become a political target for lawmakers to cut for short-term gain.

"We have finally got the imagination of people in Michigan that there can be another industry here other than the auto industry. I say give it five years before you say we can't do this."

Besides the tax incentives, Michigan has several traits that make it attractive to the film industry. Unlike Louisiana or New Mexico, which are also film hot spots, Michigan has four marked seasons. It has more than 3,000 miles of coastline along the Great Lakes, bodies of water so big their horizons are as empty as an ocean's. There are lots of charming old towns with charming old buildings, several universities and plenty of out-of-work autoworkers itching to do something with their hands, such as build sets, operate lighting systems or learn makeup artistry.

Even Michigan's economic malaise has an upside for Hollywood: Those empty, abandoned streets in Detroit are perfect for moviemakers, who can close off entire blocks for weeks without worrying about disrupting the city's flow. The Irishman, a movie due next year starring Val Kilmer and Christopher Walken, was shot in several neighborhoods of Detroit and barely interrupted city life, even when explosives were set off.

"Detroit is a fantastic resource," says Larry August, director and managing partner of Avalon Films, which has done mostly auto commercials in the past. "You have a city that was built for 1.8 million or 2 million people, and it has a lot fewer people than that (912,000 now, the Census Bureau estimates). That's the definition of a back lot. It's gritty, it's urban, and it's a very film-friendly city."

There's even a barely used high school west of Detroit in Howell, Mich., which has stood empty since 2003 because the town can't afford to operate two high schools. It's been the backdrop for at least one movie and is the location now for a pilot being shot for a sitcom for tweens.

New industry, new jobs

August has been reinventing his Royal Oak, Mich., commercial film business to cater to the burgeoning movie demand. He's also a partner in S3 Entertainment, a production house that offers to do much of the legwork for movie companies: financing, gear rental, tax-incentive consulting, catering and accounting work.

Michigan needs to get behind developing a workforce to handle the many behind-the-scenes jobs for the movie industry, August says. That would create local jobs and save filmmakers the expense of having to bring so many of those people with them.

Making movies requires skilled electricians, camera operators, art department workers, interior designers and production accountants who can keep track of costs as the movie is being made. S3 is helping train many of those workers at a local community college.

"Every movie that comes here has production accounting," August says. They have one lead accountant, and fill three to six other positions, either by bringing in folks they know or hiring people locally. But it takes training to transition from corporate accounting to movie accounting.

"The movie industry doesn't want to bring those people in," he says. "We're starting to see local people get those jobs."

Making up for lost work

Former autoworkers such as Daniel Phillips are starting to make new careers in the movie industry. Phillips worked for Chrysler for 14 years before taking a buyout in 2007, a few months before the movie tax incentives took effect.

Phillips had planned to make a living using makeup artistry skills he learned in Los Angeles years ago to beautify brides on their wedding days and models for headshots, and by making the occasional special-effects mask. His basement, he thought, would suffice as office space.

Instead, two years after opening his business, Phillips has leased space for a studio in St. Clair Shores, Mich. He's worked on gory special effects for the movie Intent, a thriller due in October, and did makeup for a children's show shot in Grand Rapids.

While he's waiting to get his union card with the International Alliance of Theatrical Stage Employees based in Detroit, he's giving makeup classes and helping train other Michigan workers on how to get into the movie business.

But he's afraid the recent film boom could be fleeting. The industry, he says, is here solely because of the tax incentives, and likely would move on if those incentives are taken away. For now, "there is no other reason they're here," he says. "Los Angeles needs to understand that this is a place where they can come and get quality work done. It's going to take some time for them to be more secure with the work ethic we have here."

Studio space on the way

More infrastructure also is needed to allow moviemakers to do more than just shoot film in the state.

Two studio facilities are expected to open within the next year. The $86 million Detroit Center Studios in downtown Detroit will create 700 jobs and will house rooms for editing and screening, soundstages, offices and a commissary. The $70 million Motown Motion Picture Studio, in a former General Motors plant in Pontiac, is projected to create 5,130 jobs doing a range of back office, creative, carpentry, lighting and other entertainment work.

In addition to building infrastructure, the state needs to be able to prove to the industry that it can provide crews for up to about seven simultaneously filming major projects, Burnstein says. That will give the state enough critical mass to convince the industry that Michigan is a reliable place to do business.

"Once the industry knows they've got the facilities and the crew base here, then we'll be able to attract more," he says.

But to be a sustainable employment option for workers, the state needs to attract more than a few movies, which come in for a several months, then leave. Burnstein says the new studios will help Michigan attract more TV series, such as HBO's Hung, which is already shot in and around Detroit. TV series "are pretty much year-round," he says. "Once they're here, they're not going anywhere."

Gamers also get tax break

Another part of the entertainment industry that qualifies for the same tax incentive is video-game software development. It's an attractive target, Burnstein says, as it's a year-round business that employs lots of highly skilled people to pull together the games. Burnstein says video-game developers are just beginning to see Michigan as an alternative to California, where the cost of living is much higher.

The entertainment business won't ever replace all the stable, middle-class jobs in Michigan that came with the auto industry, says Janet Lockwood, director of the Michigan Film Office. In 2007, before the recession hit, the auto industry pulled in $18 billion in revenue; the movie industry overall generated $9.6 billion that year. The goal now, she says, is for the state to diversify its economy, not rely on one industry to keep it afloat.

The movie industry is one worth nurturing in Michigan, she says.

"It would be a lovely ancillary industry, because it's high-tech, and will keep a lot of our youngsters home," Lockwood says. "But it will never fill the shoes of the auto industry. I don't know if anything will." (c) Copyright 2009 USA TODAY, a division of Gannett Co. Inc.

27 August 2009

14 August 2009

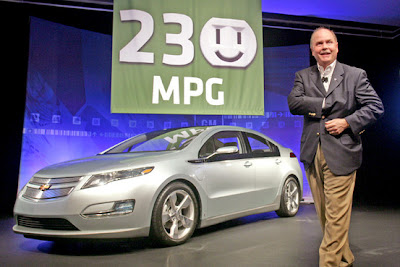

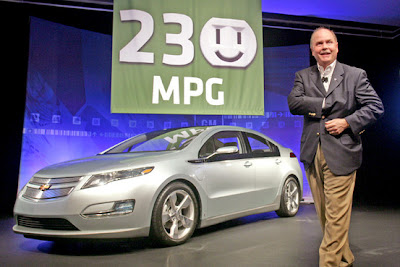

GM Hopes Volt Juices Its Future

Story by The Wall Street Journal

General Motors Co., outlining a raft of new vehicles designed to reinvigorate its lineup, said its much-awaited Chevrolet Volt is expected to get 230 miles per gallon in city driving.

The Volt is at the forefront of GM's efforts to win back lost U.S. market share with 25 product launches by 2011.

At 230 mpg, the Volt would dwarf the fuel economy of any mass-market vehicle on sale today, including Toyota Motor Corp.'s Prius hybrid, which is rated at 51 mpg in city driving. It also could deliver a big boost to GM's efforts to cultivate a green image, a key element of the company's restructuring.

The Volt is set for U.S. launch late next year as a 2011 model. The mileage expectation reflects new methodology for electric and plug-in hybrid cars being finalized by the Environmental Protection Agency that factors in electricity used to try to reach a miles-per-gallon equivalent. The intent is to allow consumers to measure the vehicles against traditional gasoline-powered ones.

The EPA said it hasn't tested the Volt.

The Volt is powered by a lithium-ion battery pack, with a range of about 40 miles, that can be recharged through a traditional power outlet. For longer drives, a small gasoline engine takes over, powering a generator that creates electricity to run the car's motors. The Volt's expected total range on one tank of gas is more than 300 miles, GM said.

Frederick "Fritz" Henderson, GM's chief executive, said at a media event that owners who charge the Volt daily could go days without the gas engine firing up. The U.S. Transportation Department says 80% of Americans commute less than 40 miles a day.

Mr. Henderson added he is confident the Volt's combined city and highway mileage -- the figure commonly used to gauge efficiency -- will be in the triple digits. "Having a car that gets triple-digit fuel economy can and will be a game-changer for us," he said.

GM's mileage estimate for the Volt promises to start a battle among auto makers as they rush to deliver electric cars, a segment that some executives believe could account for 10% of sales within four years.Nissan Motor Co. plans to launch next year the Leaf, a plug-in hatchback. On Tuesday it responded to the Volt news with a reminder that the Leaf would get a 367-mpg rating under the EPA draft guidelines. But unlike the Volt, the all-electric Leaf will need to be recharged when its battery expires after about 100 miles.

GM's mileage estimate for the Volt promises to start a battle among auto makers as they rush to deliver electric cars, a segment that some executives believe could account for 10% of sales within four years.Nissan Motor Co. plans to launch next year the Leaf, a plug-in hatchback. On Tuesday it responded to the Volt news with a reminder that the Leaf would get a 367-mpg rating under the EPA draft guidelines. But unlike the Volt, the all-electric Leaf will need to be recharged when its battery expires after about 100 miles.

Mr. Henderson acknowledged the Volt's high price, expected at around $40,000, and lack of available public recharging stations are potential challenges. Even with an expected $7,500 tax credit the Volt will cost substantially more than the $22,000 Prius. Charging the batteries should cost owners about 88 cents on average, GM said.

The Volt will be unprofitable for GM at launch because of the high costs of its development and the batteries. GM is counting on economies of scale to make the vehicle profitable eventually.

The new GM board has said it wants management to accelerate product launches. Coming models include high-end compact cars for Buick and Cadillac, a convertible version of the Chevrolet Camaro and a revamped Chevrolet Aveo subcompact.

Mr. Henderson said GM remains on track to have positive net cash flow next year and post a net profit by 2011. He also said it intends to increase production as the "cash for clunkers" rebates boost demand for its vehicles.

General Motors Co., outlining a raft of new vehicles designed to reinvigorate its lineup, said its much-awaited Chevrolet Volt is expected to get 230 miles per gallon in city driving.

The Volt is at the forefront of GM's efforts to win back lost U.S. market share with 25 product launches by 2011.

At 230 mpg, the Volt would dwarf the fuel economy of any mass-market vehicle on sale today, including Toyota Motor Corp.'s Prius hybrid, which is rated at 51 mpg in city driving. It also could deliver a big boost to GM's efforts to cultivate a green image, a key element of the company's restructuring.

The Volt is set for U.S. launch late next year as a 2011 model. The mileage expectation reflects new methodology for electric and plug-in hybrid cars being finalized by the Environmental Protection Agency that factors in electricity used to try to reach a miles-per-gallon equivalent. The intent is to allow consumers to measure the vehicles against traditional gasoline-powered ones.

The EPA said it hasn't tested the Volt.

The Volt is powered by a lithium-ion battery pack, with a range of about 40 miles, that can be recharged through a traditional power outlet. For longer drives, a small gasoline engine takes over, powering a generator that creates electricity to run the car's motors. The Volt's expected total range on one tank of gas is more than 300 miles, GM said.

Frederick "Fritz" Henderson, GM's chief executive, said at a media event that owners who charge the Volt daily could go days without the gas engine firing up. The U.S. Transportation Department says 80% of Americans commute less than 40 miles a day.

Mr. Henderson added he is confident the Volt's combined city and highway mileage -- the figure commonly used to gauge efficiency -- will be in the triple digits. "Having a car that gets triple-digit fuel economy can and will be a game-changer for us," he said.

GM's mileage estimate for the Volt promises to start a battle among auto makers as they rush to deliver electric cars, a segment that some executives believe could account for 10% of sales within four years.Nissan Motor Co. plans to launch next year the Leaf, a plug-in hatchback. On Tuesday it responded to the Volt news with a reminder that the Leaf would get a 367-mpg rating under the EPA draft guidelines. But unlike the Volt, the all-electric Leaf will need to be recharged when its battery expires after about 100 miles.

GM's mileage estimate for the Volt promises to start a battle among auto makers as they rush to deliver electric cars, a segment that some executives believe could account for 10% of sales within four years.Nissan Motor Co. plans to launch next year the Leaf, a plug-in hatchback. On Tuesday it responded to the Volt news with a reminder that the Leaf would get a 367-mpg rating under the EPA draft guidelines. But unlike the Volt, the all-electric Leaf will need to be recharged when its battery expires after about 100 miles.Mr. Henderson acknowledged the Volt's high price, expected at around $40,000, and lack of available public recharging stations are potential challenges. Even with an expected $7,500 tax credit the Volt will cost substantially more than the $22,000 Prius. Charging the batteries should cost owners about 88 cents on average, GM said.

The Volt will be unprofitable for GM at launch because of the high costs of its development and the batteries. GM is counting on economies of scale to make the vehicle profitable eventually.

The new GM board has said it wants management to accelerate product launches. Coming models include high-end compact cars for Buick and Cadillac, a convertible version of the Chevrolet Camaro and a revamped Chevrolet Aveo subcompact.

Mr. Henderson said GM remains on track to have positive net cash flow next year and post a net profit by 2011. He also said it intends to increase production as the "cash for clunkers" rebates boost demand for its vehicles.

Labels:

Chevrolet Volt,

employee buyouts gm,

general motors,

GM Future,

GM volt

Subscribe to:

Posts (Atom)